Byjus' Valuation Reporting Standards

Anurag Singal

Valuation | Financial Modeling/Review | CAJobPortal.com | CA Rankholder | IIM Ahmedabad | Registered Valuer

BYJU'S Valuation Standards

Interestingly, Bjyus' creative reporting is not just restricted to its financials, which have been the 'talk of the town' and now the subject matter of an MP's letter to ICAI's President

If we see the Valuation Reports submitted by Byjus to MCA, they are also quite instructive in terms of the inconsistency of the projections provided - its like "kuch bhi report karo, we'll manage"

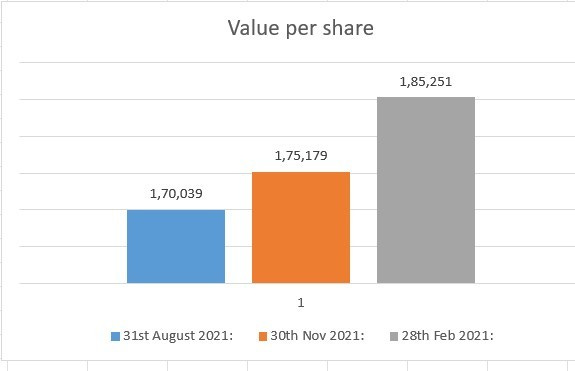

Value of CCPS (Rs/share) - same valuer for all 3 reports

31st August 2021: 170,039/-

30th Nov 2021: 175,179/-

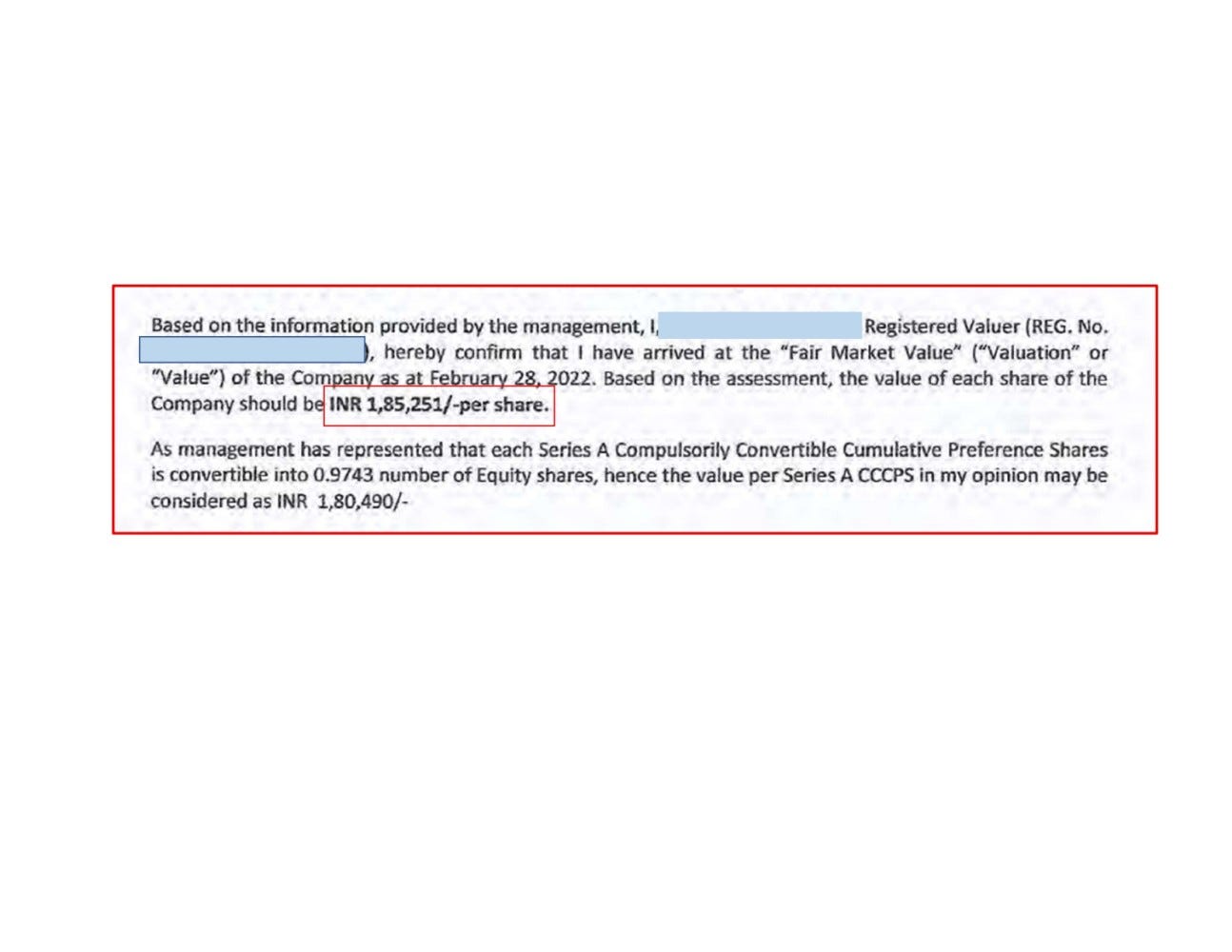

28th Feb 2021: 185,251/-

We looked into the projections appended in the report

FY 22 (7 months ) Projected Profit as per Valuation on 31st August 2021: Rs 125 cr

FY 22 (4 months) Projected Profit as per Valuation on 30th November 2021: Rs 209 cr

This is when the company posted 4564 cr loss in FY 21

Continue the story

FY 23 Projected Profit as per Valuation on 31st August 2021: Rs 382 cr

FY 23 Projected Profit as per Valuation on 30th November 2021: Rs -691 cr

Continue the story

FY 26 Projected Profit as per Valuation on 31st August 2021: Rs 5970 cr

FY 26 Projected Profit as per Valuation on 30th November 2021: Rs 8868 cr

What's really happening with India's most valuable startup

Is it creating its own reporting framework ?

Byjus Reporting Practices

#startup #byjus #financialreporting #politics #icai #creative

Also see