Maithan Alloys and 800 cr Investment | Vivek Bindra and Sandeep Maheshwari Spat- Impact on Edtech | Video on Reflections

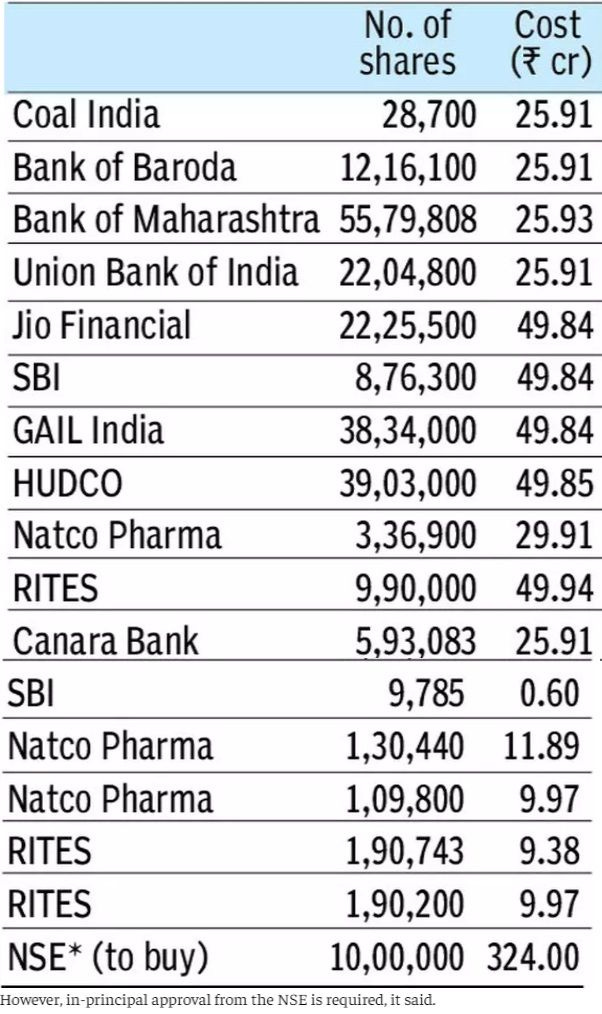

Maithan Alloys - 800 cr invested/proposed to be invested into listed/unlisted securities

Rs 800 crores invested/proposed to be invested into listed/unlisted securities by Kolkata based Maithan Alloys (btw this stock has grown 200X from the lows in 2008-09)

Now, there could be a lot of intellectual debate about this. The company had Rs 748 cr of cash on its book as on

if a company has surplus cash and no avenues for further capex, should it

a) return the excess to shareholders as dividends / buyback or

b) will it be wise to have this invested into stocks of other companies, assuming management has the investment prowess to manage the portfolio like any good mutual fund.

tax wise, maybe paying LTCG on sale of shares is better than making my company pay BuyBack Tax under section 115-O

One potential concern is that we are in a bull run - where even the proverbial pan-wallah has started talking equities- what if there is a crash in the near future and the company has to take a MTM hit

Would the company eventually have plan to demerge such investments into another company and say give shares to existing folks in 1:1

Typically markets tend to undervalue investment holdcos like Pilani Investments, Bombay Burmah Trading Corporation (BBTC) etc

What do you think?

Activate to view larger image,

#Valuation #EdTech

Imagine a situation where you are working on a Valuation Assignment for an ed-tech startup, that will impart digital skills to make people employable

Suddenly emerges a controversy in the form of a Vivek Bindra -Sandeep Maheshwaro spat and sparks fly all over social media. In between themselves, they have 5 cr followers on social media. allegations of edtech being MLM - Multi Level Marketing in disguise are all over. Trials by social media are the ugliest forms of trials

now, even if temporarily, the stakeholder confidence in quality of corporate governance practices is eroded

Byjus has already dented sentiments

Will it impact your financial model ? will you factor in lower revenues for the next 6 months or maybe longer ? will you assume lower growth or higher discount rate ?

E-Learning

Financial Modeling

Job Interview Guide

Finance For Non Finance

Mentorship with Anurag Singal